Things about Vancouver Accounting Firm

Wiki Article

Virtual Cfo In Vancouver Things To Know Before You Get This

Table of ContentsThe Greatest Guide To Vancouver Accounting FirmSome Known Incorrect Statements About Vancouver Accounting Firm Fascination About Vancouver Tax Accounting CompanySmall Business Accountant Vancouver - QuestionsThe Facts About Pivot Advantage Accounting And Advisory Inc. In Vancouver RevealedNot known Facts About Tax Consultant Vancouver

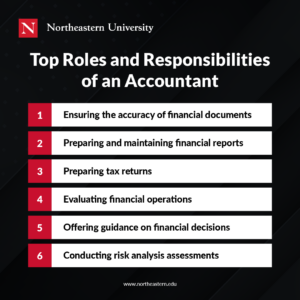

Right here are some benefits to hiring an accountant over an accountant: An accountant can provide you a comprehensive sight of your business's financial state, along with methods and referrals for making financial choices. Meanwhile, bookkeepers are only in charge of tape-recording economic deals. Accounting professionals are required to complete even more education, qualifications as well as work experience than bookkeepers.

It can be difficult to determine the appropriate time to hire an accounting expert or accountant or to identify if you need one whatsoever. While lots of small companies hire an accountant as a specialist, you have a number of choices for dealing with economic jobs. Some little company proprietors do their very own accounting on software program their accountant advises or uses, providing it to the accounting professional on a regular, month-to-month or quarterly basis for action.

It may take some history study to locate an appropriate bookkeeper because, unlike accounting professionals, they are not required to hold an expert certification. A strong recommendation from a trusted colleague or years of experience are vital factors when working with a bookkeeper. Are you still unsure if you need to employ someone to help with your publications? Below are three circumstances that suggest it's time to work with a financial expert: If your taxes have actually become too complex to manage by yourself, with multiple income streams, foreign investments, a number of deductions or various other considerations, it's time to employ an accountant.

The Vancouver Accounting Firm PDFs

For local business, skilled cash management is an essential facet of survival and development, so it's smart to collaborate with a financial professional from the beginning. If you prefer to go it alone, consider starting with audit software program as well as maintaining your publications carefully up to day. By doing this, should you need to employ a professional down the line, they will certainly have visibility right into the full monetary history of your business.

Some source meetings were conducted for a previous variation of this short article.

The 5-Minute Rule for Vancouver Tax Accounting Company

When it pertains to the ins and also outs of taxes, accountancy and money, nonetheless, it never harms to have an experienced professional to resort to for advice. A growing variety of accountants are likewise looking after things such as capital estimates, invoicing and also HR. Ultimately, numerous of them are handling CFO-like duties.Local business owners can anticipate their accountants to help with: Selecting the organization framework that's right for you is essential. It impacts how much you pay in tax obligations, the documents you need to file and your personal responsibility. If you're looking to transform to a various company structure, it might result in tax obligation small business accountant Vancouver effects and also various other complications.

Also business that are the same size as well as industry pay extremely various amounts for bookkeeping. Before we enter dollar figures, let's discuss the costs that enter into small company accounting. Overhead expenditures are prices that do not straight become a profit. These costs do not transform right into money, they are needed for running your organization.

Small Business Accounting Service In Vancouver - Questions

The typical cost of accountancy solutions for local business differs for every special situation. Because bookkeepers do less-involved jobs, their rates are frequently cheaper than accounting professionals. Your monetary service fee depends on the work you need to be done. The typical monthly accountancy charges for a small company will certainly increase as you include much more services and the tasks get more difficult.You can record transactions as well as procedure payroll using online software application. Software services come in all shapes as well as sizes.

What Does Vancouver Tax Accounting Company Mean?

If you're a new service proprietor, do not neglect to aspect accounting prices into your budget plan. Management prices and accounting professional fees aren't the only audit costs.Your time is also beneficial and should be thought about when looking at accountancy expenses. The time spent on audit tasks does not produce profit.

This is not planned as lawful guidance; to find out more, please click on this link..

The Best Strategy To Use For Vancouver Accounting Firm

Report this wiki page